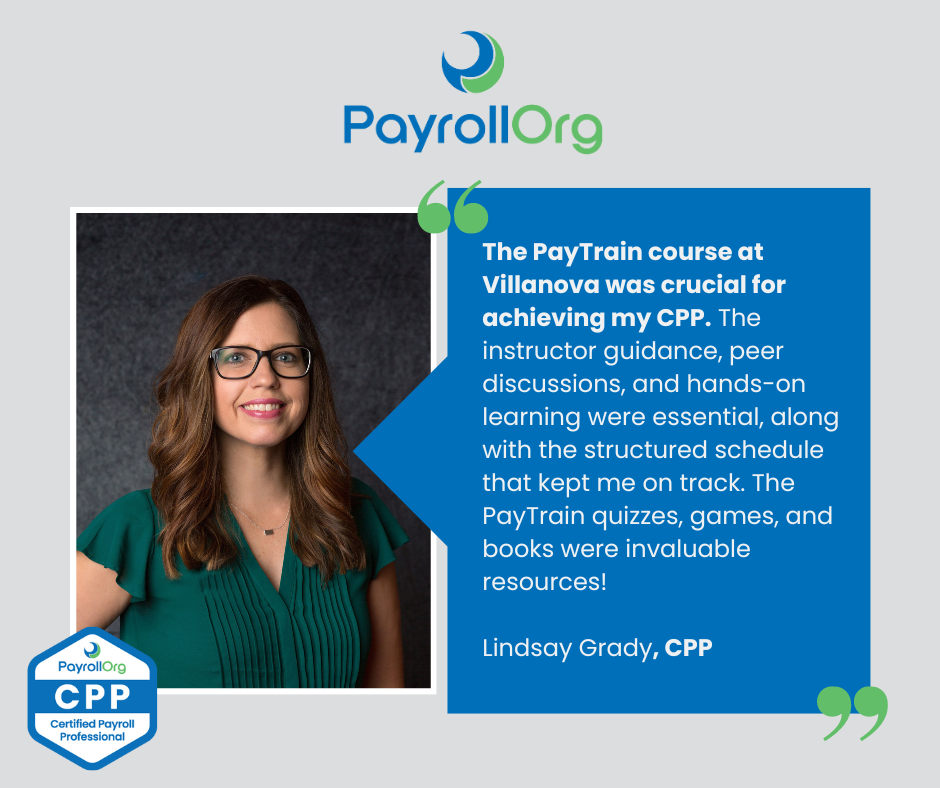

PAYO’s PayTrain® College & University program consists of two courses: PayTrain Fundamentals and PayTrain Mastery. These live, instructor-led classes are offered by colleges and universities across the U.S. as non-credit, continuing education courses.

Course One: PayTrain Fundamentals

The PayTrain Fundamentals course teaches the fundamental payroll calculations, completion of forms, and applications providing students with the essential knowledge, skills, and abilities required to maintain your organization’s payroll compliance while preventing costly penalties. This course is ideal for new payroll professionals, those who support the payroll industry, and those who are preparing for the FPC exam. PayTrain Fundamentals is a prerequisite for the PayTrain course.

Topics include the introductory study of:

- Module 1: Payroll Concepts

- Module 2: Calculations of Pay

- Module 3: Fringe Benefits & Other Payments

- Module 4: Retirement & Cafeteria Plans

- Module 5: Health Benefits

- Module 6: Payroll Reporting & Employment Taxes

- Module 7: Record Keeping & Payroll Practices

- Module 8: Payroll Accounting

- Module 9: Payroll Management Administration

- Module 10: International Payments

Course Two: PayTrain Mastery

PayTrain Mastery is a comprehensive course providing students with a solid understanding of advanced payroll topics necessary for payroll managers and supervisors responsible for their organization’s compliance. This course is ideal for experienced payroll professionals seeking compliance training, professional development, or CPP exam preparation. Please note that the PayTrain Fundamentals course is a prerequisite for PayTrain Mastery.

Topics include the advanced study of:

- Module 1: Payroll Concepts

- Module 2: Calculations of Pay

- Module 3: Fringe Benefits and Other Payments

- Module 4: Retirement & Cafeteria Plans

- Module 5: Health Benefits

- Module 6: Payroll Reporting & Employment Taxes

- Module 7: Record Keeping & Payroll Practices

- Module 8: Payroll Accounting & Auditing

- Module 9: Payroll Management Administration

- Module 10: International Payments

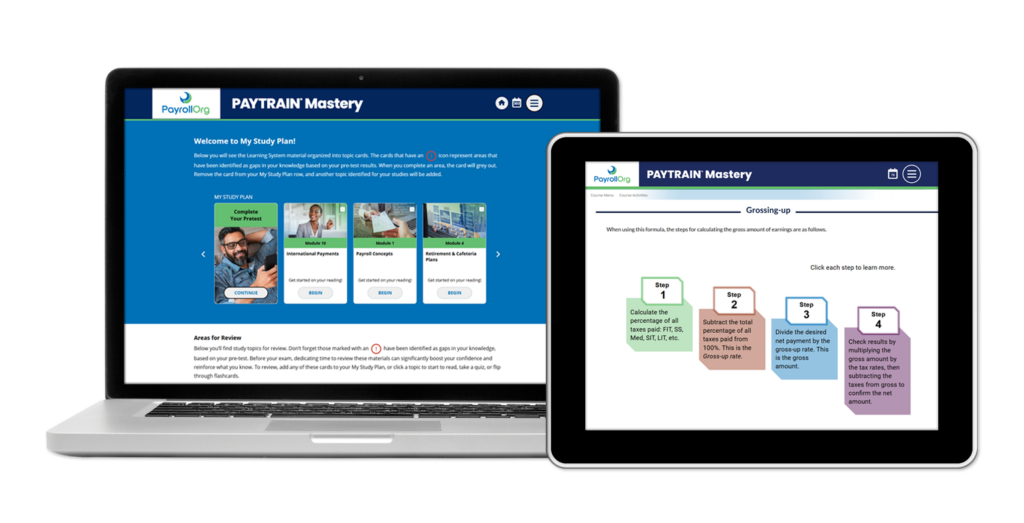

Course Components

The PayTrain College & University program combines live instruction with comprehensive reading materials and interactive study tools to reinforce what you learn. To accommodate the needs of busy professionals, each institution sets their own schedule with classes being held on evenings and weekends. Course instructors have years of payroll experience to share with class participants.

- Determine your current knowledge with the online assessment.

- Identify topics for improvement to help guide your studies.

- Read learning modules that cover payroll concepts, recent changes, trends, and best practices.

- Listen as you read along to boost your comprehension.

- Reinforce your learning with quizzes, calculations, exercises, and flashcards.

- Build exam-day confidence with a post-test that mimics the CPP exam format and weighting.

- Score 80% or higher on the post-test to qualify for a certificate of achievement and earn Recertification Credit Hours (RCHs) or Continuing Education Units (CEUs).

Interactive Study Tools

Key learning components include:

Assessment

- Online Pre-test helps determine your current knowledge and identify areas for improvement.

Calculations

- Complete calculations for each topic based on scenarios provided.

- Hints and feedback guide you in developing the calculation and payroll skills.

Exercises

- Complete exercises for each topic based on scenarios provided.

- Answer a series of questions by filling in a form, completing an entire paycheck calculation, etc.

Module Quizzes

- Check your understanding of the lessons covered in reading modules, calculations, and exercises.

- Decide whether you need further study or practice on the topic.

Flashcards

- Printable and online flashcards are included.

- Practice learning key terms and concepts reinforcing your knowledge.

Glossary

- Look up key terms from anywhere in the system with the glossary.

- Use the Search box or browse by letter.

Resource Center

- Additional resources including tax tables, forms and publications mentioned in the modules.

- Certification information on PayrollOrg website.

- Feedback forum for evaluation and suggestions.

- Payroll updates with legislative changes and new developments.

Post Tests

- Tests are weighted and balanced based on the same percentages as the FPC exam.

- Includes flag for review, review each item, and time limits, similar to the FPC exam.

Reports

- Track your progress, compare the results of quizzes and pre- and post-tests.

- View a breakdown of your quiz scores by module to determine your learning gain.